Comprehensive Nikkei 225 Analysis for January 19, 2024

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the Nikkei 225 for 19th January 2024.

Nikkei 225 Key Takeaways

- Beneficiaries of the depreciation of the yen: Before the Bank of Japan clearly changes its negative interest rate policy, the prospects for the appreciation of the yen will not be clear. The depreciation of the yen supports a rebound in exports, so the probability that the Japanese stock market will continue to rise will still exist.

- The Nikkei ETF has greater risk: Because China’s Nikkei ETF currently has a premium risk that the secondary market price is significantly higher than the Nikkei net worth. In addition to the liquidity and exchange rate risks of QDII funds, Nikkei ETFs are relatively risky from an investment perspective. You can pay attention to the Nikkei 225 CFD .

Nikkei 225 Technical Analysis

Nikkei 225 Daily Chart Insights

- Stochastic Oscillator: The indicator enters the overbought area and begins to consolidate, suggesting that the current bullish sentiment is beginning to slow down. Be wary that the indicator sends a short signal after the market price encounters resistance in the upward channel line.

- Price Action: The price formed a pin bar on January 11, and the price broke through the high of pin bar in the following two days, suggesting that bulls are still strong. Although the price subsequently fell back and adjusted, it was still judged to be long before it fell below the low of January 11.

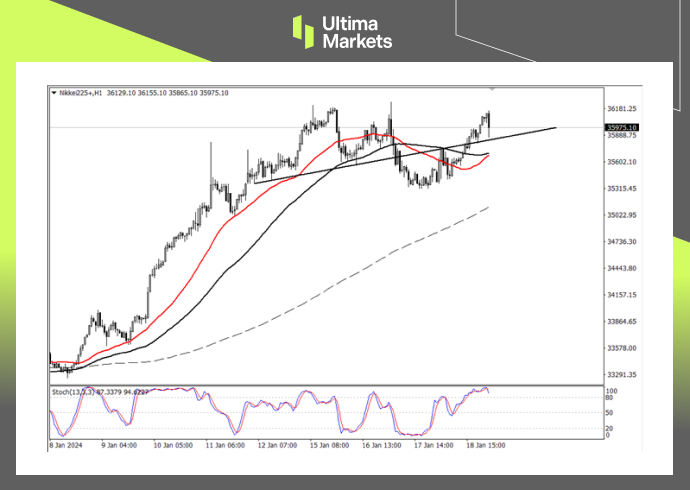

Nikkei 225 1-hour Chart Analysis

- Stochastic Oscillator: The indicator once again issued a short signal after entering the overbought area, suggesting that the current exchange rate may be adjusted during the Asian session. Wait for the indicator to leave the overbought area and pay attention to whether there are long signals.

- Support line: Nikkei 225 formed an M-top pattern this week, and the price stood above the neckline yesterday after falling below the neckline. The neckline has changed from the previous resistance level to a support price. The market price may consolidate around the neckline, waiting for the red 33-period moving average to cross the black 65-period moving average.

Trading Central Pivot Indicator

- According to the trading central in Ultima Markets APP, the central price of the day is established at 35800,

- Bullish Scenario: Bullish sentiment prevails above 35800, first target 36240, second target 36410;

- Bearish Outlook: In a bearish scenario below 35800, first target 35560, second target 35400.

Conclusion

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4